The Rally Ventures SaaS+ Playbook

An Introduction to SaaS+

A key investment focus for Rally Ventures is an emerging wave of business known as SaaS+.

In addition to their core software product, SaaS+ platforms employ embedded fintech and other products as a secondary revenue model. By doing so, SaaS businesses can add new streams of revenue and build a more valuable product for their customers. Rally Ventures coined the term SaaS+ because the plus refers to these additional capabilities added to the core SaaS platform.

Vertical SaaS platforms are particularly good candidates for SaaS+ business models because the platforms that best serve the specific needs of an industry tend to become the platform of record for that vertical. If a SaaS platform can successfully build trust with customers who rely on their core software product, those customers will first look to them for added products and services.

Most people will be glad to use the platform’s additional products and services as long as they’re well integrated, provide similar economics to other options in the market and do not require additional work from their staff. Examples of these additional products and services could include payment processing, treasury management, funds distribution, revolving credit, card issuing, insurance and background screening.

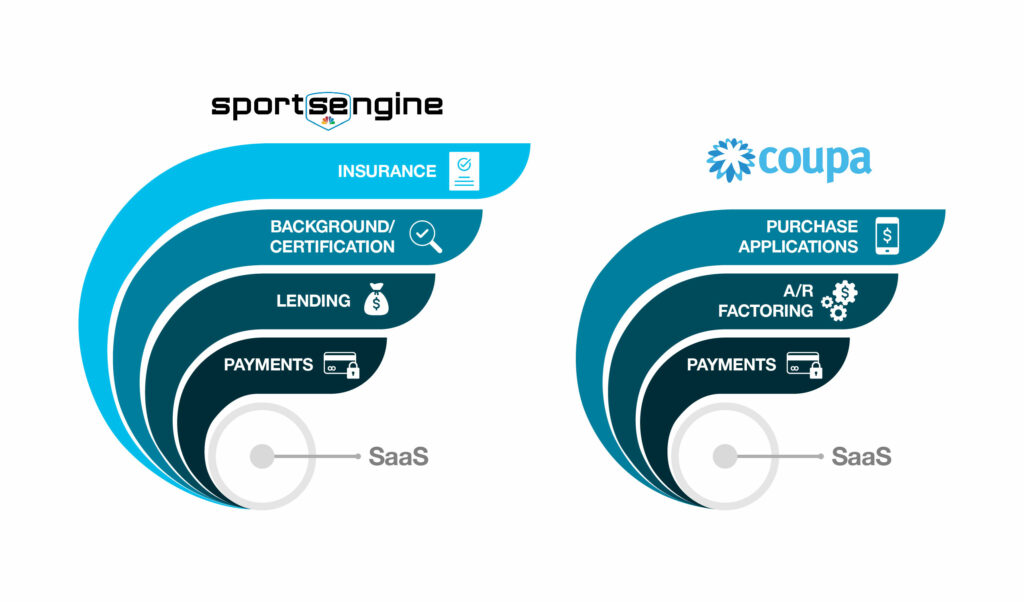

SportsEngine, a vertical SaaS platform, was one of the first companies to employ the SaaS+ business model at billions of dollars of annual funds flow scale. They recognized early on that their customer base of youth sports organizations didn’t have easy access to the financial products and services they needed. SportsEngine went on to add payment processing, funds distribution, insurance, embedded e-commerce, background screening and more to their platform, and, as a result, evolved from primarily flat fee monthly revenue to over 80% usage based revenue. This evolution drove median customer ARR up by 5x-10x.

Justin Kaufenberg was the Co-Founder and CEO of SportsEngine prior to joining Rally Ventures as a Partner. Rally was the lead investor in SportsEngine, and our team worked directly with Justin as he built the company from an early-stage opportunity to the largest sports-focused SaaS and payments company in the world.

Horizontal SaaS platforms can also be great candidates for SaaS+. Coupa, a platform that could be used in any industry to manage procurement and spend, was another early investment at Rally Ventures that pioneered the SaaS+ model.

Coupa consolidates purchasing for businesses to take advantage of volume discounts, and then takes a cut of the savings. They became a SaaS+ company when they got involved in the flow of payments and started generating additional revenue streams on top of their core software subscription.

Other well-known SaaS+ companies outside of the Rally portfolio include Shopify and Toast. Both companies offer payments and other embedded financial services on their platforms. Toast launched Toast Capital last year to help restaurants secure loans.

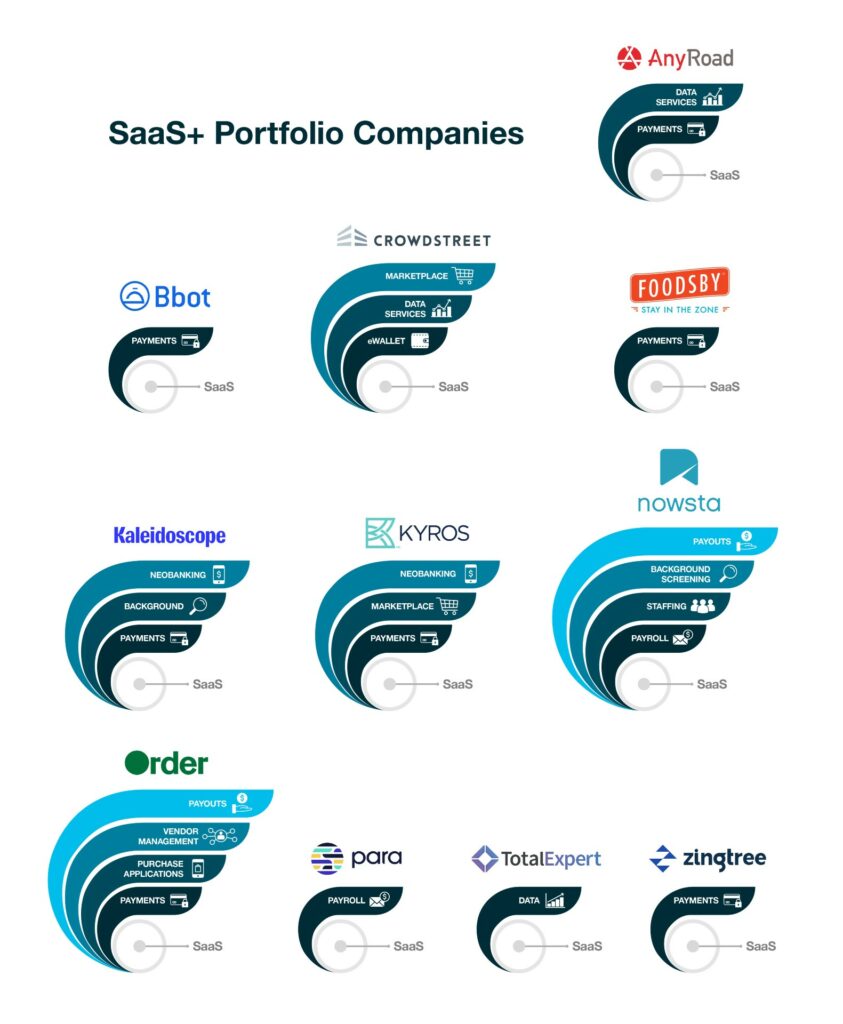

The Rally Ventures team has founded or invested in over 10 SaaS+ companies in the past decade, and it makes up a significant percentage of our current portfolio. Our team of veteran investors and advisors has unique experience in this emergent business model and a strong track record of success deploying our SaaS+ playbook.

There are two additional companies in the Rally portfolio that act as enablers to the SaaS+ model. JustiFi, which offers a full suite of embedded fintech tools, and Yardstik, a fully integrated human security software platform, are the “plus” that other platforms can integrate and monetize to become SaaS+ platforms.

The benefits of building a SaaS+ company are numerous. SaaS+ platforms capture a customer’s traditional software spend as well as the spend on additional products and services. These SaaS+ revenue sources can easily grow to be a multiple of your SaaS revenue with customers typically adopting new tools in a series of ramping motions that compound dramatically over time.

Because SaaS+ businesses are creating new products and services to serve their existing customer base, they’re uniquely attuned to the needs of their customers and are better able to solve complex problems. The real magic in SaaS+ occurs when the fintech stack is both integrated in the core Saas platform and built with industry specific work flows native to the tools. This combination is untouchable by traditional horizontal financial services providers as they require customers to learn yet another system. The new system also lacks the deep customer intelligence that the vertical Saas platform naturally enjoys. That lack of data results in suboptimal economics and end user experiences.

Platforms that embrace the SaaS+ business model can capture new revenue, create stickier products, have market leading Net Revenue Retention and dominate their industry. Done well, the SaaS fee serves as little more than skin in the game to ensure implementation, but is eventually dwarfed by the SaaS+ sources of revenue. These additional lines of business can consistently 5X-10X the value of each customer.

This article is the first in a series of articles about SaaS+ that we’ll be sharing over the coming months. We’re excited to dig deeper into the benefits of building a SaaS+ company and the details of how it’s done. We’ll cover a variety of topics, like how to think about code level technical architecture, organizing sales in a SaaS+ world, managing the customer hand-off between sales and customer success, stack ranking of Saas+ monetization options and much more. We’ll bring in guest contributors, real world examples and detailed how-tos.